Retirement Millionaire Review – A Practical Guide to Long-Term Wealth

- February 14, 2026

- Uncategorized

In today’s unpredictable financial climate, planning for retirement can feel overwhelming. Markets move quickly, inflation shifts purchasing power, and economic headlines often create more anxiety than clarity. For investors who want stability rather than speculation, having reliable research matters more than ever.

That’s where the Retirement Millionaire newsletter enters the picture.

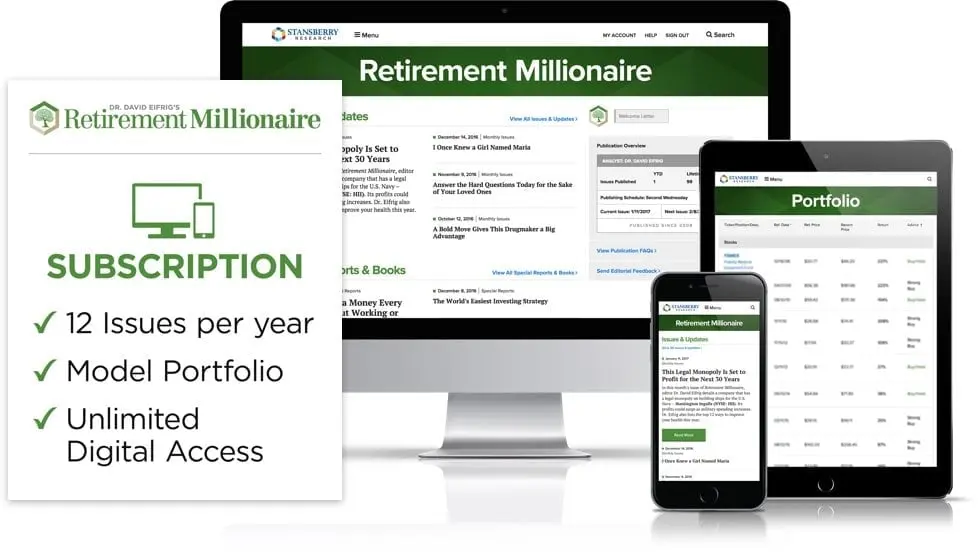

Published by Stansberry Research and led by veteran investor and physician Dr. David Eifrig, Retirement Millionaire is built around one core idea: growing and protecting wealth through disciplined, long-term investing. Instead of chasing market hype or short-term trading wins, the service focuses on steady progress and intelligent risk management.

What Is Retirement Millionaire?

Retirement Millionaire is a monthly investment research newsletter designed primarily for conservative and retirement-focused investors. Its mission is simple — help readers navigate market uncertainty without exposing themselves to unnecessary risk.

Each month, subscribers receive a detailed issue that analyzes the current economic environment and explains how it may impact portfolios. Dr. Eifrig translates complex financial themes into clear insights, allowing readers to understand not just what to do, but why a particular strategy makes sense in the broader market context.

Unlike high-pressure investment promotions, the tone of Retirement Millionaire is calm and measured. The focus is not on “getting rich quickly,” but on preserving capital while generating consistent long-term returns.

Who Is Dr. David Eifrig?

A major reason for the newsletter’s popularity is the background of its editor. Dr. David Eifrig brings a rare combination of Wall Street experience and medical training to his research.

Before entering the publishing world, he worked at Goldman Sachs, where he specialized in derivatives and fixed income trading. Later, he pursued medicine and earned his medical degree. This unique career path shaped his analytical style.

He approaches investing much like a physician approaches diagnosis — by examining evidence carefully, assessing risk, and making decisions based on data rather than emotion.

Over the years, he has guided subscribers through multiple market cycles, including financial crises, inflationary periods, and sharp corrections. His emphasis has consistently remained on protecting readers from major losses while positioning them for steady gains.

How the Retirement Millionaire Works?

Subscribers receive a new issue of Retirement Millionaire each month. These reports typically center around a major economic theme — such as interest rate movements, inflation trends, currency shifts, or global policy changes — and then connect that theme to specific investment opportunities.

Rather than overwhelming readers with technical jargon, the newsletter explains market conditions in plain language. Recommendations include reasoning behind each investment, price guidance, and insight into how the position fits within a broader portfolio strategy.

In addition to monthly reports, members gain access to ongoing updates. When market conditions shift unexpectedly, Dr. Eifrig communicates quickly with guidance on whether to hold steady, adjust positions, or take profits. This steady communication adds reassurance during volatile periods.

The Model Portfolio Advantage

One of the most appreciated aspects of Retirement Millionaire is its live model portfolio. This feature allows subscribers to see every active recommendation in one place, including entry points and performance history.

The transparency builds confidence. Instead of vague claims about past successes, readers can observe how recommendations evolve. They can choose to mirror the portfolio directly or use it as a framework for their own investing approach.

For many subscribers, this structured visibility eliminates guesswork and reduces emotional decision-making.

Investment Philosophy Behind Retirement Millionaire

At its core, Retirement Millionaire follows a conservative growth strategy. The emphasis is placed on reliable companies, dividend income, and tangible assets that can weather economic uncertainty.

Dr. Eifrig prioritizes capital preservation first. In his view, avoiding significant losses is one of the most powerful ways to build wealth over time. Markets inevitably experience downturns, and positioning defensively when needed helps maintain long-term progress.

Income generation is another major pillar of the strategy. Dividend-paying investments can provide a steady cash flow, especially important for retirees who depend on portfolio income.

The approach is methodical rather than aggressive. Instead of trying to predict every short-term move, Retirement Millionaire seeks sustainable opportunities that can compound steadily.

Educational Value Beyond Stock Picks

What separates Retirement Millionaire from many other investment newsletters is its educational component. Each issue teaches readers how economic forces influence markets. Over time, subscribers begin to recognize patterns and trends independently.

The research archive also contains special reports on topics such as inflation protection, gold investing strategies, tax efficiency, and retirement planning techniques. These materials function as a long-term financial education library.

Rather than simply telling subscribers what to buy, the newsletter helps them understand why certain strategies work under specific economic conditions.

Who Should Consider Retirement Millionaire?

Retirement Millionaire is particularly suited for investors who value stability over speculation. It appeals to individuals nearing retirement, those already retired, and anyone seeking a lower-risk path to financial security.

It may not be ideal for short-term traders looking for rapid gains. The service requires patience and a willingness to let investments grow over time. However, for those focused on sustainable wealth building, the approach feels practical and realistic.

Pricing and Risk-Free Trial

The subscription is typically offered at a discounted introductory rate, making it accessible to a broad range of investors. Importantly, the service includes a 30-day money-back guarantee. This allows new members to review the research, explore the model portfolio, and evaluate the content without financial pressure.

Such a policy demonstrates confidence in the value of the newsletter and gives potential subscribers flexibility before committing long-term.

Final Thoughts

Retirement planning requires clarity, discipline, and consistency. In a world filled with financial noise and speculation, Retirement Millionaire provides a steady voice grounded in research and experience.

Under the leadership of Dr. David Eifrig, the newsletter focuses on protecting capital, generating reliable income, and identifying sustainable growth opportunities. It avoids hype and instead emphasizes thoughtful, long-term strategies.

For investors seeking a calm and structured approach to building retirement wealth, Retirement Millionaire stands out as a practical and trustworthy resource.

If you’d like, I can now optimize this further for search engines with a high-converting SEO title and meta description, or adapt it into a more persuasive affiliate-style version.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing involves risk, and past performance is not indicative of future results. Readers should perform their own due diligence or consult a licensed financial advisor before making any investment decisions.